A budget is simply a plan for your money. It shows you exactly where your money comes from and where it goes. Learning how to be on a budget gives you direct control over your finances. This isn’t about restriction; it’s about empowerment and intentional spending. A clear budget helps you reduce financial stress, save more money, and pay off debt faster. It’s truly a powerful tool for your financial journey.

Key Takeaways

Understand your money. Know how much you earn and where it goes. This helps you plan your spending.

Set clear money goals. Decide what you want your money to do. This gives your budget a purpose.

Choose a budget method that fits you. Options like the 50/30/20 rule or the envelope system can help you manage your money.

Track your spending. See where every dollar goes. This helps you find areas to save money.

Review and adjust your budget often. Your budget is a tool that changes with your life. Make it work for you.

Understand Your Finances

Before you can truly take control of your finances and create a working budget, you need to know where you stand. This means getting a clear picture of your income and your spending. It’s your financial starting point. You must understand your current situation before you can plan for the future.

Calculate Your Income

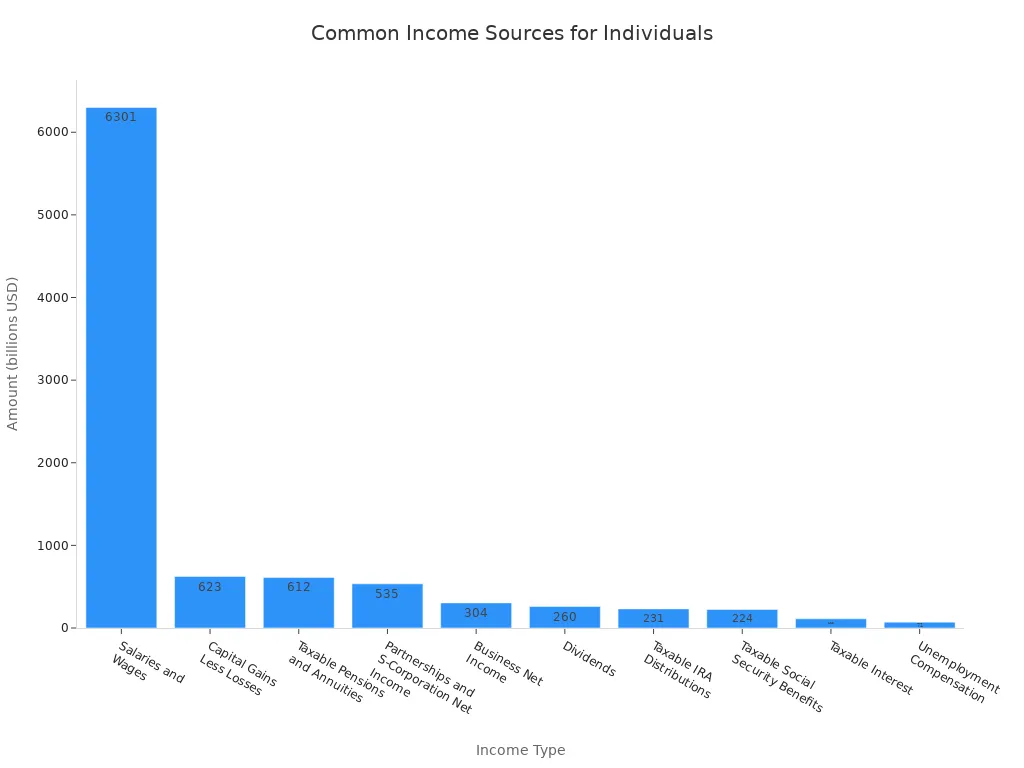

First, figure out how much money you bring in each month. This is your income. Think about all your income sources. Most people get salaries or wages. But you might have other income too, like money from a side job or investments. Look at this chart to see common income sources for individuals:

Knowing all your income streams helps you build an accurate monthly budget. You want to account for every dollar you receive.

List All Expenses

Next, you need to list everything you spend money on. This can feel like a big task, but it’s very important. You want to see where your money goes. Here are some typical categories for household expenses:

Housing: Mortgage or rent, property taxes, repairs, maintenance.

Utilities: Electricity, gas, water, trash service, sewage, recycling fees.

Transportation: Costs for daily commute, public transportation, car ownership (fuel, maintenance).

Food: Groceries (essentials like bread, milk, eggs, cheese; non-essentials like snacks, candy, dessert).

Household Supplies: Cleaning supplies, toiletries, personal hygiene products.

Insurance: Various types of insurance.

Personal Spending: Gym memberships, clothes, shoes, haircuts, home decor, furniture, gifts.

Recreation & Entertainment: Concert tickets, sporting events, family activities, vacations, streaming services, hobbies.

Write down every expense. This helps you manage your money better.

Needs Versus Wants

As you list your expenses, think about needs versus wants. Needs are things you must have to live. Wants are things that make life more fun but are not essential. Understanding this difference is key for your budget.

Financial Needs (Essential):

Debt obligations (student loans, credit cards, car loans)

Health care (check-ups, medications, emergency care)

Housing (rent/mortgage, insurance, taxes, maintenance)

Groceries (basic, nutritious foods)

Transportation (public transport, gas, tolls, maintenance)

Utilities (electricity, gas, water, phone, internet)

Financial Wants (Non-Essential):

Dining out

Entertainment

Leisure activities

Non-essential purchases (gadgets, designer clothing)

Travel

This distinction helps you make smart choices with your finances.

Steps for Making a Budget

You’ve looked at your income and expenses. Now it’s time to put that information to work. This section shows you how to start making a budget that truly helps you. It’s about creating a clear spending plan for your money.

Set Financial Goals

Before you even think about numbers, you need to know what you want your money to do for you. Setting financial goals is the first step in building a budget. What do you want to achieve? Maybe you want to save for a down payment on a house, pay off debt, or build an emergency fund.

To make your goals effective, use the SMART method:

Specific: Clearly define your goal. For example, don’t just say “save money.” Instead, say, “I want to have enough in my savings account to cover a surprise car bill or repair.”

Measurable: Quantify your goal. How much money do you need? “$1,000 to cover repairs and other unexpected expenses.”

Attainable: Break down the goal into smaller, manageable steps. How much do you need to save monthly to reach $1,000 within a set timeframe?

Relevant: Make sure your goals align with your values and what you truly want for your future.

Time-bound: Set a deadline for your goal. This encourages you to take action.

For instance, a goal could be: “In order to have $1,000 saved up for an emergency car repair within the next 6 months, I will set aside $166 from my monthly income and move it to a separate savings account just for emergencies.” This kind of clear goal gives your budget a purpose.

Allocate Funds

Once you know your goals, you need to decide where your money goes. This is called allocating funds. You’ve already calculated your income. Now, you need to figure out your net income, which is your take-home pay after taxes and deductions. This is the money you have to work with for your monthly budget.

Next, categorize your expenses. You already listed them, but now think about them as fixed or variable.

Fixed expenses stay the same each month, like rent or a car payment.

Variable expenses change, like groceries or entertainment.

When you allocate funds, you determine your total spending requirements. This means looking at all your costs. You should also build in a small buffer, maybe 5-10%, for unexpected increases. This helps you avoid stress if something costs a little more than you planned.

You also need to identify your funding methods. Where will the money come from to cover these allocations? It will come from your net income. The budget allocation process details where your funds originate.

Choose a Budget Method

There are many ways to approach how to budget. Choosing the right method makes building a budget easier for you. Here are some popular options:

Budgeting Method | Characteristics |

|---|---|

50/30/20 Rule | Divides income into 50% for needs, 30% for wants, and 20% for savings and debt repayment. It’s simple, flexible, and ideal for beginners. |

Zero-Based Budgeting | Assigns every dollar of income to a specific purpose (bills, savings, spending) so that income minus expenses equals zero. Provides high structure and control, but requires more tracking effort. |

The Envelope System | Involves physically (or digitally) setting aside cash for specific spending categories. Helps build discipline and stick to spending limits, especially for those who struggle with overspending. |

The 50/30/20 Rule is great if you want a simple guideline. It’s easy to understand and gives you flexibility. However, it might not work if your needs take up more than 50% of your income.

Zero-Based Budgeting gives you a lot of control. You tell every dollar where to go. This is powerful for reaching specific goals or if your income changes a lot. But it does take more time and effort to track everything.

The Envelope System is perfect if you tend to overspend with cards. Using cash for certain categories makes you more aware of your spending limits. It builds discipline, but it might not be practical for all expenses, like online bills.

Think about your lifestyle and what feels most comfortable for you. You can even mix and match parts of these methods to create a system that works best for how to be on a budget.

How to Start Budgeting Effectively

You’ve set your goals and picked a budget method. Now it’s time to put your plan into action. This part shows you how to start budgeting effectively and make it a regular habit.

Track Spending

The first step to effective budgeting is knowing exactly where your money goes. You need to meticulously track all your spending for at least a month. This helps you understand your real spending habits. You might be surprised by what you discover!

Many tools can help you track your money. You can use apps like Simplifi by Quicken, which connects to your bank accounts and credit cards. It gives you a real-time dashboard of your spending, categorizes transactions, and even helps you set savings targets. Another great option is PocketGuard. Its “In My Pocket” feature shows you how much disposable income you have after bills and savings. If you prefer a more hands-on approach, Goodbudget uses a digital envelope system. You can also try Monefy for simple, manual transaction entry and visual spending charts.

As you track, pay close attention to those small, everyday purchases. These often add up quickly. People often overlook expenses like:

Non-monthly bills: Think about property taxes, HOA dues, or car insurance that you pay quarterly or yearly.

Unexpected car repairs and regular maintenance: Oil changes, new tires, or even a surprise repair can hit your wallet hard.

Doctor’s visits: Copays, prescriptions, or urgent care visits are common but often forgotten in a budget.

Subscriptions: Those monthly or annual fees for streaming services, gym memberships, or even Amazon Prime can sneak up on you.

Pet care: Vet visits, food, or even a pet sitter can be significant costs.

Gifts: Birthdays, holidays, and special occasions mean you spend money on others.

“Fun Money“: Those daily lattes, vending machine snacks, or impulse buys can really add up.

Miscellaneous stuff: Printer ink, seasonal lawn care, or ride-share fees are small but frequent.

Tracking these items helps you see where your money truly goes.

Review and Adjust

After tracking your spending for a month, you have a clear picture. Now, subtract your total expenses from your total income. This shows you if you have a surplus (money left over) or a deficit (you spent more than you earned).

A popular guideline for allocating your income is the 50/30/20 rule:

50% for Needs: This covers your essential living expenses like housing, utilities, groceries, and transportation.

30% for Wants: This includes things that improve your quality of life but are not essential, like dining out, entertainment, or hobbies.

20% for Savings and Debt Repayment: This portion goes towards building your emergency fund, saving for future goals, or paying down debt faster.

You should review your budget regularly. Many financial experts recommend checking in weekly, monthly, or quarterly. This helps you recalculate your net income, review expenses, and measure progress toward your financial goals. You should also audit any outstanding debt and check your emergency fund status.

Don’t wait until the end of the month if big financial changes happen. If you get a raise, lose your job, or have unexpected medical expenses, adjust your budget immediately. Your budget is a living document. It needs to change as your life changes.

Handle Irregular Income

Budgeting can feel tricky if your income isn’t the same every month. This is common for freelancers, commission-based workers, or those with seasonal jobs. But you can still master how to be on a budget with irregular income.

Here are some effective budgeting tips for this situation:

Prioritize spending: Make sure you cover your fixed, essential expenses first. These are your needs. Then, allocate funds to flexible items. You might even make some fixed expenses more flexible. For example, choose a pay-as-you-go gym membership instead of a long-term contract.

Track your money diligently: Knowing where every dollar goes is even more important with irregular income. This helps you spot “money leaks” like impulse purchases. Try recording all your spending for a month. You might find surprising insights into your habits.

Build a buffer: Try to save enough during high-income months to cover your essential expenses for a few low-income months. This creates a safety net.

Seek free professional help: Many banks and credit unions offer tools and apps. Resources like “The Build-a-Budget Book” from Penn State Extension or the Consumer Financial Protection Bureau’s toolkit can also guide you.

With these strategies, you can create a stable financial plan, even when your income varies.

Mastering Your Personal Budgeting

Mastering your personal budgeting means you make sure your income covers all your expenses and still leaves room for savings. This balance is key to financial freedom.

Cut Costs

Look closely at your spending. A crucial starting point for budgeting involves distinguishing between necessities and luxuries. Necessities are things you must have for basic survival and well-being. Think about food, housing, healthcare, and education. Luxuries are non-essential items that make life more enjoyable, like dining out, vacations, or high-end electronics.

You can find many ways to trim your expenses. Meal planning can lead to significant savings. It helps you maximize grocery purchases and reduces the temptation to eat out. This also promotes healthier eating habits. Consider these common areas to cut back:

Housing

Transportation

Food

You can also trim grocery expenses by shifting to cheaper brands or shopping at discount stores. Cancel unused services like streaming platforms, gym memberships, or magazine subscriptions. Reevaluate costly outings, such as expensive theme park tickets or hotel stays. Instead, opt for local community events, free concerts, or outdoor festivals. Implement energy-saving steps at home, too. Switch to energy-efficient appliances, use LED light bulbs, and turn off lights or unplug electronics when not in use. These small changes add up in your budget.

Increase Income

Sometimes, cutting costs isn’t enough. You might need to find ways to bring in more money. Consider a side hustle, like freelancing or selling crafts online. You could also sell items you no longer need around your house. If you are employed, think about asking for a raise or taking on extra shifts. Every extra dollar helps you reach your financial goals faster.

Build Emergency Savings

A core part of personal budgeting is saving money for emergencies. Life throws unexpected challenges your way. You might face a sudden illness or accident. An unexpected job loss can happen. You could also have a surprise home repair or a car repair. These events can quickly derail your finances if you are not prepared.

The amount you need for an emergency savings fund depends on your situation. Consider past unexpected expenses and their costs to help set a personal savings goal. Even a small amount can offer financial security, especially if you live paycheck to paycheck. Start by saving $1,000. Then, aim to save 3 to 6 months’ worth of essential expenses. This safety net is vital for learning how to be on a budget successfully.

Budgeting gives you incredible power over your finances. It brings you financial freedom and peace of mind. Start small with your budget. Be patient with yourself, and celebrate every step you take. Remember, budgeting is not a one-time fix. It’s a journey where you learn and adapt. You are taking control of your financial future. This is how to be on a budget successfully.

FAQ

What is the best budgeting method for me?

The best method fits your lifestyle. If you like simplicity, try the 50/30/20 rule. For strict control, zero-based budgeting works well. If you struggle with overspending, the envelope system can help. Experiment to find what feels right for you. 💡

How often should I check my budget?

You should check your budget regularly. Many experts suggest weekly or monthly reviews. This helps you stay on track. If your income or expenses change, adjust your budget right away. It is a living document. 🗓️

What if I go over budget in a category?

Don’t worry if you go over budget sometimes. Just adjust other categories to compensate. You can cut back on wants or find ways to earn more. Learn from it and make changes for next time. Budgeting is a learning process. 🌱

Is budgeting only for people with low income?

No, budgeting is for everyone! It helps you manage your money no matter how much you earn. Budgeting helps you reach financial goals. It gives you control over your money. Everyone can benefit from a budget. 💰