You want to grow your wealth. You can achieve this goal through strategic stock market investing. Learning how to make money in stocks is possible. It requires long-term commitment to quality businesses, not quick schemes. This method helps you make money. It offers real potential for wealth creation and financial independence. This guide provides a clear roadmap to make money in stocks successfully.

Key Takeaways

Open an investment account to start buying stocks, bonds, and funds. Choose the right account type for your financial goals.

Invest in good companies that show strong financial health. Look for businesses with consistent profits and growth potential.

Use a ‘buy and hold’ strategy. Keep your investments for a long time to benefit from market growth and lower taxes.

Be patient and disciplined. Do not make quick decisions based on emotions. Stick to your investment plan.

Spread your money across different investments. This helps lower your risk and protects your portfolio from big losses.

Getting Started: How to Make Money in Stocks

You need a place to hold your investments. This is your first step to make money in stocks. You open an investment account. This account lets you buy and sell various assets. These assets include stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These accounts can also offer tax advantages.

Open an Investment Account

You must open an investment account to begin. Investment accounts hold your assets. They hold stocks, bonds, funds, and other securities. They also hold cash. The value of these assets can change. You can choose from several types of accounts. These include retirement accounts, brokerage accounts, education accounts, and health savings accounts.

Choose the Right Account Type

Selecting the correct account type is important. Each type offers different benefits.

Brokerage Accounts: These accounts offer great flexibility. They have no income or contribution limits. You get a wide array of investment options. You can withdraw funds at any time. This appeals to many savers. However, you pay taxes when you sell assets or receive dividends. You may face capital gains taxes and dividend taxes.

Traditional IRA: You can contribute to a Traditional IRA. Your contributions might be tax-deductible. Earnings grow tax-deferred. You do not pay capital gains tax on investments held inside. You pay ordinary income tax when you withdraw money later.

Roth IRA: You contribute to a Roth IRA with after-tax money. Your investments grow tax-free. Qualified withdrawals are also tax-free. You will not owe capital gains tax when you sell stocks within a Roth IRA. This applies if you meet certain conditions.

You can also buy company stock directly. Some companies offer direct stock purchase plans. This lets you buy shares without a broker.

Consider Stock Funds or ETFs

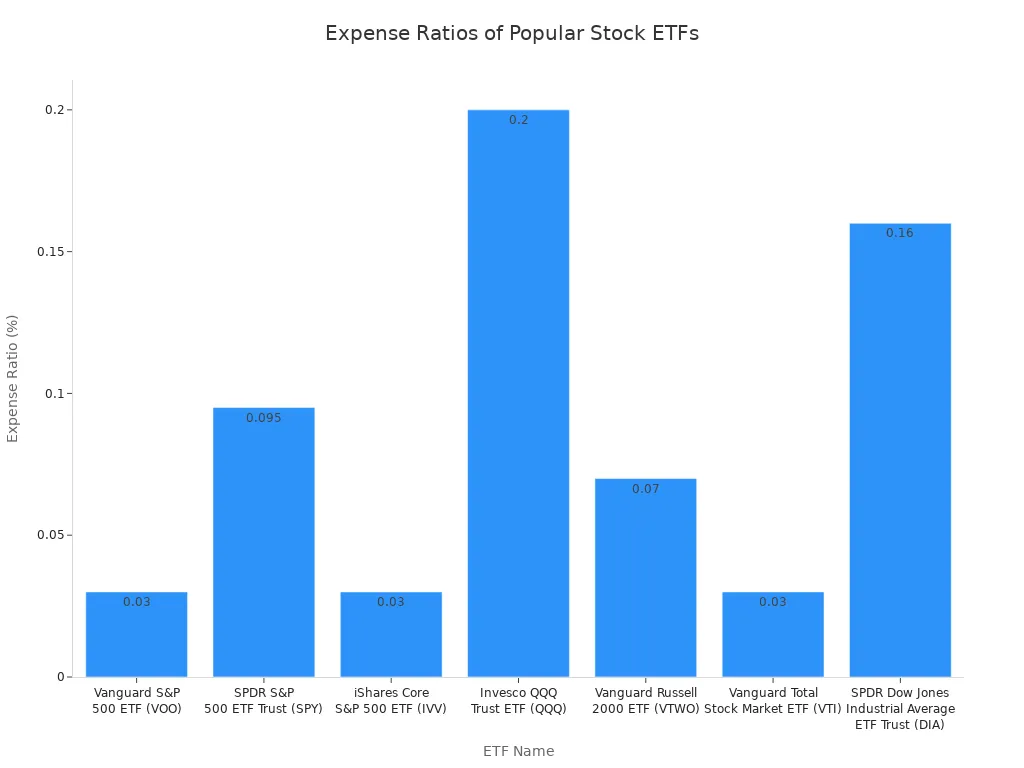

You can also invest in stock funds or ETFs. These options help you diversify easily. ETFs are popular choices. They often have low expense ratios. An expense ratio is a fee you pay. It covers management and operating costs.

Here are some typical expense ratios for popular stock ETFs:

ETF Name | Expense Ratio |

|---|---|

Vanguard S&P 500 ETF (VOO) | 0.03% |

SPDR S&P 500 ETF Trust (SPY) | 0.095% |

iShares Core S&P 500 ETF (IVV) | 0.03% |

Invesco QQQ Trust ETF (QQQ) | 0.2% |

Vanguard Russell 2000 ETF (VTWO) | 0.07% |

Vanguard Total Stock Market ETF (VTI) | 0.03% |

SPDR Dow Jones Industrial Average ETF Trust (DIA) | 0.16% |

Average stock ETF (2023) | 0.15% |

These low fees help you keep more of your earnings. This is how to earn money in stock exchange effectively. You can earn money from the stock market by choosing wisely.

Key Principles for Stock Selection

You want to make money in stocks. You must understand how to choose promising companies. This involves fundamental analysis. You look at a company’s health and potential. This section guides you through selecting stocks wisely.

Invest in Quality Businesses

You should invest in good businesses. These companies show reliable outperformance over time. They behave resiliently across different business cycles. They offer defensiveness during crises. Quality stocks also provide an asymmetric risk profile. This means they capture more upside than downside.

Quality businesses have strong business models. They show consistent financial results. This leads to more predictable performance. These companies deliver steady, robust returns. They do this across various market scenarios. They also protect your portfolio during market downturns. Quality is a defensive factor. It can also participate in market upside. This makes it ideal for long-term investments.

Understand Capital Appreciation

Capital appreciation is a key way to make profit in stock market. It happens when your investment’s value increases. The stock price goes up from your purchase price. This appreciation combines with other income, like dividends. Together, they form your total investment return. For example, a stock with a 6% price increase and a 4% dividend yield gives you a 10% total return.

Capital appreciation often drives long-term returns. This is especially true for growth-focused strategies. It acts as the “growth engine” for your total return. Companies often reinvest earnings into research and expansion. This helps their stock price grow. Capital appreciation significantly increases asset value over time. It helps you achieve financial goals. These goals include retirement or funding education.

Leverage Dividend Income

Many companies share their profits with shareholders. They do this through dividends. Investing in dividend-paying stocks can boost your returns. You can also reinvest these dividends. This is a powerful strategy.

Dividend reinvestment plans (DRIPs) automatically use your cash dividends. They buy more shares of the same stock. This turns your earnings into a self-fueling growth engine. New shares then earn their own dividends. This leads to significant compounding over many years. It dramatically boosts portfolio growth. You do not need to add more money. This “snowball effect” is central to long-term wealth creation. Historically, dividends form a large part of total returns. Reinvesting these payouts ensures your potential returns actively contribute to principal growth. This is how to earn money in stock exchange effectively.

Dividend reinvestment offers many benefits:

Effortless Investing: You do not need to decide what to do with dividend cash. Your money stays invested.

Built-In Dollar-Cost Averaging: Dividends reinvest regularly. You buy more shares when prices are low. You buy fewer when prices are high. This smooths your average cost per share.

Commission-Free Purchases: Many plans let you reinvest dividends without trading commissions. This saves you money over time.

Accelerates Capital Growth: Each dividend buys more shares automatically. This increases your ownership. It also increases your future earning potential.

Inflation Protection: Reinvesting helps your portfolio grow faster than inflation. This preserves your purchasing power.

Research Companies Effectively

You must research companies thoroughly. This helps you identify promising businesses. William J. O’Neil’s approach suggests looking for companies with strong earnings growth. You also look for optimal buying times. You study financial statements. You understand business models. You analyze profit sources. This helps you make informed investment decisions.

You should examine three core financial statements:

Income Statement

Balance Sheet

Cash Flow Statement

These statements are connected. They offer insights into a company’s financial performance. They show its strength, profitability, and liquidity. They are essential for assessing financial health.

You also look at financial metrics. These metrics indicate a strong and stable business.

Profitability KPIs: Gross profit margin, net profit margin.

Liquidity KPIs: Current ratio, quick ratio.

Efficiency KPIs: Inventory turnover, accounts receivable turnover.

Valuation KPIs: Earnings per share, price to earnings ratio.

Leverage KPIs: Debt to equity, return on equity.

Gross Profit Margin measures profitability. It shows how well a company generates profit from sales. Net Profit Margin is a comprehensive measure. It shows profit after all expenses. The Operating Cash Flow Ratio measures a company’s ability to pay short-term debts. It uses cash from operations.

You must also look for red flags in financial reports. These can signal trouble.

Operating cash flow is negative for many quarters.

Net income consistently exceeds operating cash flow.

Free cash flow is always negative or declining.

Weak liquidity means difficulty meeting short-term obligations.

Profit margins are narrowing.

Revenue and profit trends do not match industry peers.

Assets grow faster than revenues.

Dividend payout ratio is near or above 100%.

Aggressive or unjustified revenue recognition.

Frequent changes in accounting policies without good reason.

Unexplained transactions and adjustments.

Weak internal controls.

Inconsistent numbers across statements.

Slow-moving inventory.

Unusually steady profits despite industry downturns.

Sudden spikes in revenue near period-end.

High levels of non-recurring items inflate earnings.

Discrepancies between revenue and cash receipts.

Large, unexplained debts on a balance sheet.

A continuous decline in cash flow from operations.

Understanding these principles helps you make money. It helps you make money in stocks.

Long-Term Strategies to Make Money

You want to build wealth over time. You need sustainable investment strategies. These strategies help your money grow. They focus on long-term success, not quick gains.

Adopt a Buy and Hold Strategy

A “buy and hold strategy” means you buy investments and keep them for a long time. You do not sell them often. This approach helps you stay invested through market ups and downs. It is a recommended way to make money.

Historically, the stock market grows over the long term. Holding your investments allows you to benefit from this growth. Your money can compound over many years. This means your earnings start to earn their own earnings.

This strategy also reduces your costs. You trade less often. This means fewer transaction fees and commissions. This helps you keep more of your money.

A buy and hold strategy can also be tax-efficient. You hold assets long enough to get lower long-term capital gains tax rates. Gains on stocks you hold for over a year are taxed at a lower rate. This rate is 15% for most investors. If you sell a stock held for less than a year, your gains are taxed as ordinary income. This rate can be much higher, up to 37%. Delaying sales helps you save on taxes.

Practice Patience and Discipline

Investing requires patience and discipline. You must avoid making quick decisions based on emotions. Emotional investing can hurt your returns.

For example, over a 20-year period ending in 2022, the average investor earned 6% annually. The market benchmark (S&P 500) earned 9% annually. Emotional decisions can reduce your returns by 1-2% each year.

Impact of Emotional Investing | Average Investor Returns | Market Benchmark (S&P 500) |

|---|---|---|

Over 20-year period (ending 2022) | 6% annually | 9% annually |

Impact of Emotional Investing | Reduction in Investor Returns Annually |

|---|---|

Due to emotional decision-making | 1-2% |

Many psychological biases affect investors.

Loss Aversion: You feel the pain of losses more strongly than the joy of gains. This can make you sell during market downturns. You lock in losses instead of waiting for recovery.

Overconfidence: You might overestimate your skills. This can lead to risky decisions.

Herd Behavior: You might follow what others do. This can lead to buying at market peaks or selling during panic.

Fear can make you more pessimistic. It can reduce your willingness to invest. Studies show that fear reduces risk-taking. This happens even when you do not have information about outcomes. Stress and financial worries also make you less likely to take risks.

Emotional states can lead to irrational choices. You might buy or sell based on daily news. You might chase market trends. This can disrupt your long-term plans. It often reduces your returns. You must focus on your long-term goals. You must stick to your investment plan.

Implement Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a smart strategy. You invest a fixed amount of money at regular times. You do this regardless of market conditions. This helps you make money by reducing the impact of market volatility.

This strategy smooths out your purchase price over time. You buy more shares when prices are low. You buy fewer shares when prices are high. This can lower your average cost per share.

DCA helps you avoid investing a large sum at a bad time. For example, you avoid investing all your money at a market peak. This makes it a safer approach for many investors. It helps you avoid trying to time the market. It also reduces the impact of investor psychology. You avoid panic selling or overbuying.

By investing consistently, you reduce the overall impact of market ups and downs. You can view market downturns as chances to buy more shares at a lower price.

While DCA reduces volatility, lump-sum investing can sometimes lead to higher absolute returns. Lump-sum investing means you invest all your money at once. However, DCA helps you manage risk and emotions. It is a good strategy for consistent investing.

Manage Risk and Protect Investments

You must manage risk to protect your investments. This ensures your portfolio’s safety and longevity. You can grow your wealth over time by understanding and controlling risks.

Diversify Your Portfolio

Diversification is key. You spread your investments across different assets. This lowers your overall risk. You do not put all your eggs in one basket.

True diversification goes beyond just stocks. You include asset classes like bonds, commodities, and real estate. These assets often perform differently from stocks. This helps lower your portfolio’s overall risk and volatility. A balanced mix of lower-risk assets (like bonds) and higher-risk assets (like stocks) helps your portfolio grow. It also protects you from market swings. Diversification is a risk management strategy. It focuses on reducing volatility and potential losses.

You can diversify your stock holdings too. The optimal number of stocks for diversification depends on the type of stock:

Portfolio Style | Optimal Number of Stocks |

|---|---|

Large-cap | ~15 |

Small-cap | ~26 |

Non-dividend | ~26 |

Growth and Value | Roughly equal number for optimal volatility reduction |

The amount of money you invest does not directly dictate the optimal number of stocks. Your willingness to research and manage many holdings influences it. Diversification is crucial no matter how much you invest. You can use Exchange Traded Funds (ETFs) for instant diversification across many stocks.

Invest in What You Understand

You should invest only in what you understand. Avoid complex products or companies you know nothing about. This protects you from potential scams and bad investments. Many investment scams target uninformed investors.

“If you don’t understand it, don’t invest in it.”

Common investment scams include:

Pump & Dump Scheme: Fraudsters spread false information to inflate a stock’s price. They then sell their shares for profit.

Forex Scam: Investors are promised opportunities in foreign exchange. Their money is lost to the scheme operators.

High-Yield Investment Program (HYIPs): These are fraudulent investments. They promise extremely high returns.

Boiler Room Scheme: Fraudsters use high-pressure sales tactics through cold calls. They persuade people to invest.

Understanding your investments helps you avoid these traps. It helps you make profit in stock market safely.

Set Realistic Expectations

You must set realistic expectations for returns. The market does not always go up. Returns will not be consistent every year. Long-term investors should expect periods of lower returns. Market downturns are unavoidable.

Historically, a 60% stock/40% bond portfolio averaged 9.5% annual returns since 1950. However, investor expectations can be much higher. In 2000, investors expected over 30% returns. By 2017, U.S. respondents reported an average return of 7.44%.

Vanguard’s Capital Markets Model® forecasts annualized returns of about 3.5% to 5.5% for U.S. equities over the next 10 years (as of December 10, 2025).

Market corrections happen. They are normal. From 1980-2023, the average peak-to-trough decline was -14.8%. The average time to recover was 150 days. Patience and proper diversification lead to normalized returns over longer periods. This rewards you for taking on volatility. This is how to earn money in stock exchange.

Making money in stocks is a journey. It demands discipline, patience, and informed decision-making. This guide showed you how to make money in stocks. You start smart by opening the right account. You focus on quality businesses. You adopt long-term strategies. You manage your risk effectively. Consistent learning and avoiding emotional decisions are crucial for sustained success. You can achieve significant financial growth and reach your investment goals.

FAQ

How much money do I need to start investing in stocks?

You can start with a small amount. Many brokers allow you to buy fractional shares. This means you can invest with as little as $5 or $10. Focus on consistent contributions, not just the initial sum.

How long does it take to make money in stocks?

You should plan for the long term. Stock market investing works best over many years. Aim for at least 5 to 10 years. This allows your investments to grow and recover from market downturns. Patience is key.

Should I invest in individual stocks or ETFs?

ETFs offer instant diversification. They are good for beginners. Individual stocks require more research. You can choose individual stocks if you enjoy detailed company analysis. Many investors use both for a balanced approach.

What is the biggest mistake new investors make?

New investors often make emotional decisions. They buy when the market is high. They sell when the market is low. You must stick to your plan. Avoid reacting to daily news. Discipline protects your returns.