The Banking System links you to businesses and the economy every day. When you deposit money or take out a loan, you help create a ripple effect. Your bank uses deposits to fund loans for others, which lets people buy homes and businesses grow. This activity multiplies spending and supports jobs in your community. Banks do more than process checks and run ATMs. Their true impact is hard to measure because they provide so many services. When people lose trust in banks, the whole economy can slow down. Understanding how banks work helps you make better choices for your future.

Key Takeaways

The banking system connects people, businesses, and the economy, helping manage money and support growth.

Banks provide essential services like loans and deposits, which help create jobs and stimulate local economies.

Trust in banks is crucial; when people feel secure, they are more likely to use banking services, benefiting everyone.

Community banks focus on local relationships, offering personalized service and supporting regional growth.

Digital banking and fintech innovations make financial services more accessible, helping more people manage their money effectively.

The Banking System Explained

What Is It?

You interact with the banking system almost every day, even if you do not notice it. The banking system is a network of banks and financial institutions that help you manage money. It connects people, businesses, and the government. You can think of it as a set of layers that work together to keep your money safe and make transactions easy.

Here is a simple table that shows the main layers of the banking system and what each one does:

Layer | Description |

|---|---|

Presentation Layer | This is the part you see. It includes online banking, ATMs, and bank tellers. |

Application Layer | This layer handles things like checking your balance or processing a loan. |

Data Access Layer | It helps the system find and use your information quickly and safely. |

Database Layer | This is where your account data and transaction history are stored securely. |

Infrastructure Layer | This layer includes the servers and networks that keep everything running smoothly and safely. |

Each layer works together to make sure you can access your money, pay bills, and save for the future. The banking system uses these layers to protect your information and provide fast service.

Main Functions

The banking system does more than just hold your money. You rely on it for many important services. Here are some of the main functions:

You can deposit money and withdraw it when you need it.

Banks lend money to people and businesses, helping them buy homes or expand.

The Federal Reserve sets rules to keep banks safe and stable.

The Office of the Comptroller of the Currency checks that national banks follow the law.

The Federal Deposit Insurance Corporation protects your deposits, so you do not lose money if a bank fails.

New rules like Basel III help banks stay strong during tough times.

Tip: When you use the banking system, you help keep the economy moving. Your deposits and loans support jobs, businesses, and growth.

Connections

People and Banks

You interact with banks in many ways every day. When you open a savings account, deposit your paycheck, or use a debit card, you rely on the banking system to keep your money safe and accessible. Banks help you save for the future and make payments quickly. Trust in banks encourages you to use these services more often, which helps you manage your finances better.

Here is a table that shows how trust and savings grow when people use banks:

Finding | Description |

|---|---|

Increased Trust | People feel more confident using banks when they see positive results. |

Savings Increase | Savings rates go up when people use banks for cash transfers and income. |

Trust and Inclusion | Trust in banks helps more people use formal financial services. |

You can choose from many financial products and services. Here are some of the most common ones:

Banks accept deposits, lend money, and help you make payments.

Insurance companies protect you from financial loss.

Brokerage firms let you buy and sell stocks and bonds.

Regulatory agencies make sure banks follow the rules and stay safe.

When you use these services, you help the banking system work smoothly. Your deposits allow banks to lend money to others, which supports spending and investment in your community.

Note: Building trust in banks not only helps you save more but also brings more people into the financial system.

Businesses and Banks

Businesses depend on banks for many reasons. You might see a local store using a bank to process payments or a large company borrowing money to expand. Banks offer loans, manage cash, and provide other services that help businesses run smoothly.

Banks help businesses by offering fast and reliable cash management. For example, a small business can get cash management products from a bank in less than a day. This quick service helps businesses avoid delays and focus on growth. Banks also use technology platforms to serve more clients and build long-term relationships.

Here is a table that shows how banks support business operations:

Evidence | Description |

|---|---|

Cash Management Dominance | Banks help businesses handle money across different parts of the company, making work easier. |

Banks play a key role in business growth and sustainability. They provide most of the funding that businesses need to start, grow, and become more sustainable. When banks lend to businesses that care about the environment, they help create a greener economy. Regulations also encourage banks to support sustainable practices.

Findings | Implications |

|---|---|

Banks are primary funding sources for businesses. | Banks drive business growth and job creation. |

Green recovery needs banks to lend to eco-friendly businesses. | Banks can lead the way in sustainable business practices. |

Incentives help banks focus on sustainability. | Aligning bank goals with sustainability benefits everyone. |

Tip: When you support businesses through the banking system, you help create jobs and encourage innovation in your community.

Economic Impact

The banking system connects people and businesses, but its influence goes even further. It shapes the entire economy. When banks work well, they help the economy grow by making it easier for people to spend, save, and invest. Banks move money from savers to borrowers, which funds new businesses and builds infrastructure.

If banks face trouble, the whole economy can suffer. For example, banking distress can lower the country’s GDP, increase unemployment, and reduce investment. Here are some effects of banking problems:

Real GDP per person can drop by 1.3% after a banking crisis.

Unemployment can rise by 1.0 percentage point within two years.

Real investment per person can fall by 7.6% after three years of distress.

Systemic banking crises can have a much bigger impact than smaller problems.

Banks also help the economy in other ways:

They connect savers with borrowers, making sure money goes where it is needed most.

They give loans to new businesses, which creates jobs and supports innovation.

They make it easy for you to buy things, which keeps the economy active.

They provide a safe and reliable payment system.

They help manage risks and keep the economy stable.

They make sure there is enough money available for people and businesses.

Central banks use the banking system to guide interest rates and control credit.

Callout: The Banking System acts as the backbone of the economy. When you use banking services, you help support growth, stability, and opportunity for everyone.

Financial Inclusion

Access for Individuals

You may notice that not everyone has the same access to banking services. Many people still face barriers when trying to open accounts or use financial tools. The Banking System works to close these gaps and bring more people into the formal financial world.

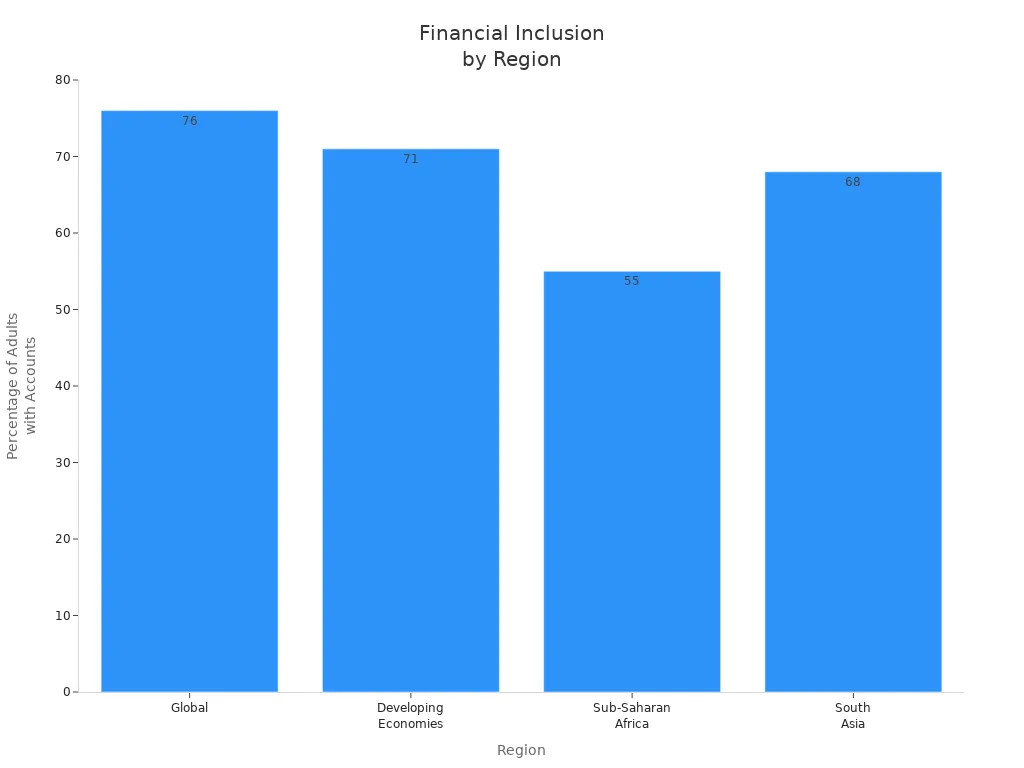

Here is a table showing how many adults have bank accounts in different regions:

Region | Percentage of Adults with Accounts | Mobile Money Account Ownership | Overall Financial Inclusion Rate |

|---|---|---|---|

Global | 76% | N/A | N/A |

Developing Economies | 71% | N/A | N/A |

Sub-Saharan Africa | 55% | 33% | N/A |

South Asia | 68% | N/A | N/A |

You might wonder why some people do not use banks. Common barriers include distance from branches, lack of financial knowledge, and cultural beliefs. Many people say they avoid banks because they live far away or do not understand how banking works. Some groups, like people with disabilities, face extra challenges due to inaccessible locations and limited education.

Tip: Financial literacy programs and mobile banking help more people open accounts and manage money safely.

Here is a table that shows barriers and solutions:

Barrier to Financial Access | Evidence Supporting Banking Initiatives |

|---|---|

Geographical Distance | Many financially excluded individuals report that they do not go to banks due to geographical distance, which is exacerbated for people with disabilities by inaccessible bank branches and ATMs. |

Lack of Financial Literacy | ICT-based financial education programs can increase financial literacy among people with disabilities, helping them overcome barriers to access. |

Cultural Factors | Research indicates that cultural mindsets contribute to the lack of demand for formal financial services among people with disabilities, necessitating targeted interventions. |

You can see that financial literacy training and mobile money accounts make a big difference. When you learn about banking, you gain confidence and start using more financial services.

Access for Businesses

If you run a small business, you know that access to credit and banking services is vital. Many small and medium-sized businesses (SMEs) struggle to get loans from traditional banks. Banks often see these businesses as risky, so they limit lending.

Recent changes allow fintech companies to offer small business loans, making it easier for you to get funding.

During the pandemic, fintechs helped many businesses by providing quick loans through programs like PPP.

In some regions, such as MENAP, 32% of SMEs say that getting credit is their biggest challenge.

Fintech platforms now work with e-commerce and food delivery companies to give merchants fast access to working capital.

For example, in Pakistan, fintech companies partner with online stores to help merchants grow by offering instant credit. This support lets you scale your business and manage cash flow better.

Note: When banks and fintechs work together, you get more options for financing and can focus on building your business.

Community Banks

Local Relationships

You often find that community banks feel different from larger banks. They focus on building strong relationships with you and your neighbors. When you walk into a community bank, you notice that the staff knows your name and understands your needs. These banks offer personalized customer care and tailor their services to fit your life.

Personalized customer care helps you feel valued and understood.

Local decision-making means you get answers faster because decisions happen right in your community.

Community banks often offer lower fees and better interest rates than big banks.

They reinvest in local projects, which helps your town grow.

Community banks also show commitment and flexibility. They work with you to find solutions that fit your unique situation. You can trust them to focus on your long-term financial health.

Community banks build relationships with local customers through personalized care, local decision-making, competitive rates, and a strong community focus. This approach fosters trust and loyalty, as you feel valued and understood.

Regional Growth

Community banks play a big role in helping your region grow. They know the local market and spot good investment opportunities that larger banks might miss. This is important for small businesses, especially those that need loans but do not have much collateral.

Local banks have a unique advantage in identifying good local investment opportunities that national banks might overlook. This is particularly important for service-oriented businesses that rely on relationship lending due to low collateral. Over the past 35 years, areas with more local banks have seen a significant increase in service job growth, particularly in the food services and alcohol industry, with an increase of 13 percentage points in employment growth.

You see the impact when new restaurants or shops open in your area. Community banks offer different loan options, like term loans and lines of credit, which help small businesses get started and grow. They respond quickly to loan requests, so businesses can act fast.

A case study on alcohol legalization shows that counties with more local banks experienced a 13 percentage point increase in service job creation, translating to about 29 new jobs per year for two years after legalization.

The Banking System relies on community banks to support local economies. When you choose a community bank, you help create jobs and boost growth in your region.

Evolution of Banking

Historical Perspective

You can trace the roots of banking back thousands of years. Early banks started in ancient Mesopotamia around 2000 BCE, where temples kept valuables safe. Over time, banking grew and changed. Here are some major milestones that shaped the industry:

Temples in ancient Mesopotamia acted as the first banks.

Ancient Greece introduced standardized coins around 600 BCE, making trade easier.

Banking centers rose in medieval Europe, especially in Italy during the Renaissance.

The Bank of Amsterdam opened in 1609, marking the start of modern banking.

The Bank of England was founded in 1694 and became a model for central banks.

The first central bank in the U.S. appeared after the Revolutionary War.

The Federal Reserve System began in 1913 to oversee banking activities and keep the economy stable.

The Bretton-Woods agreement made the U.S. dollar the world’s reserve currency.

The invention of ATMs in the 1960s and the rise of fintech changed how you interact with banks.

You see that each milestone brought new ways to manage money, protect savings, and support growth. The Banking System has always adapted to meet your needs.

Modern Integration

Today, you experience banking in ways that people in the past never imagined. Technology has transformed how you access financial services. You can use your phone or computer to check balances, transfer money, and apply for loans.

Evidence Description | Impact on Banking Practices |

|---|---|

Shift from traditional banking to digital banking | Enhanced operational efficiency and customer engagement |

Rise of FinTech companies | Adoption of innovative business models and improved service delivery |

Use of AI and blockchain technologies | Increased processing efficiency and risk assessment accuracy |

You rely more on digital platforms for banking. Banks and technology firms work together to create new business models. You benefit from faster payments and better management of your financial data. Fewer physical branches exist now because you can do almost everything online.

Tip: You can use digital banking to save time and manage your money more easily. Technology helps banks serve you better and keep your information safe.

Benefits

Security & Trust

You want to know your money is safe when you use a bank. Banks work hard to build trust with you and other customers. They do this by keeping your money secure and solving problems quickly. When banks stay stable and respond to your needs, you feel more confident using their services. The whole banking industry depends on public trust. If people lose faith in banks, the economy can slow down.

Here is a table that shows what shapes your trust in banks:

Key Findings | Description |

|---|---|

Public Confidence | Public confidence grows when banks show financial stability and respond to client concerns. |

Bank Characteristics | Each bank’s unique features help shape your trust, even if risks are controlled. |

Industry Stability | A stable banking sector increases trust in individual banks and supports the wider economy. |

Tip: You help keep the system strong by choosing banks that value security and customer care.

Resource Allocation

Banks play a big part in making sure money goes where it is needed most. They collect savings from people like you and lend that money to businesses and families. This process helps the economy grow. Banks use careful planning and risk checks to manage resources well. When banks compete, they often find better ways to give out loans and support new ideas.

Studies show that banks with good management and strong rules use resources more efficiently. This leads to better service for you and helps the economy. City banks sometimes face challenges at first, but smart policies and risk controls can improve how they support local businesses.

Note: Efficient banks help connect the real economy with financial markets, making sure money supports growth and new jobs.

Opportunity

The Banking System gives you many chances to reach your goals. You can save for college, buy a home, or start a business. Banks offer loans, savings accounts, and other tools to help you succeed. When banks support new businesses, they create jobs and help communities grow. You benefit from these opportunities, and so does the whole economy.

You can use banking services to build a better future.

Banks help turn your ideas into real projects.

Communities grow stronger when everyone has access to financial tools.

Callout: When you use banks wisely, you open doors for yourself and others.

Challenges

Digital Change

You see banks changing fast as they move into the digital world. Many banks now use apps, online banking, and new technology to serve you better. This shift brings many benefits, but it also creates new challenges. You may notice that some people struggle to keep up with these changes. Older adults or people without internet access can find digital banking hard to use. Banks must help everyone learn how to use new tools. They also need to make sure their systems work for all customers, not just those who are tech-savvy.

Tip: If you feel unsure about digital banking, ask your bank for help or training. Many banks offer guides or workshops to help you get started.

Security & Privacy

As banks use more technology, keeping your information safe becomes harder. You trust banks with your money and personal data. Banks know this and work hard to protect you. They use strong access controls, watch for threats all the time, and train their employees to spot problems. Banks also follow strict rules to keep your data private. These steps help banks keep your trust and stay ahead in a digital world.

You should always use strong passwords and never share your banking details. If you see something strange in your account, tell your bank right away.

Regulation

Banks must follow many rules to keep the system safe and fair. These rules can be hard to manage, especially for smaller banks. High compliance costs make it tough for small banks to compete. When this happens, big banks get bigger, and you have fewer choices.

Regulatory Challenge | Description |

|---|---|

Compliance Complexity | Banks must follow different rules in each country, which slows them down. |

Data Governance | Banks need to keep data clean and well-managed to meet high standards. |

Operational Burden | New rules mean banks must change how they work all the time. |

You see banks focus more on transparency and better data quality. They also add risk checks to daily work. These steps help banks meet rules and keep your money safe.

Future Trends

Digital Banking

You see banks changing fast as technology grows. Digital banking lets you manage your money from anywhere. You can use mobile apps to check balances, pay bills, or send money. Many people now choose mobile banking because it is quick and easy. Online banking platforms help you open accounts and track spending without visiting a branch. Some banks operate only online, giving you a simple and streamlined experience. Artificial intelligence helps banks give you advice and answer questions right away. Digital payments, like mobile wallets and contactless cards, make shopping safer and faster.

Trend | Description | Adoption Insight |

|---|---|---|

Rise of Mobile Banking | More people use mobile apps for banking. | Mobile banking is gaining popularity. |

Growth of Online Banking | Online platforms help manage accounts. | More customers use online banking for transactions. |

Emergence of Digital-Only Banks | Banks work only online, no branches. | Digital-only banks offer streamlined experiences. |

Increasing Use of AI | Banks use AI for advice and support. | AI improves customer experience. |

Growth of Digital Payments | Mobile wallets and contactless payments are rising. | Digital payments are popular for secure transactions. |

Tip: You can save time and avoid lines by using digital banking tools.

Financial Technology

You notice new companies changing how banks work. Financial technology, or fintech, brings fresh ideas to payments, lending, and saving. Fintech makes banking easier for people who live far from branches. You can get loans or send money using your phone. Small businesses find new ways to borrow money when banks say no. Fintech helps people in developing countries skip old banking systems and join the financial world.

Fintech creates new ways to pay and borrow.

You get access to banking even in rural areas.

Small businesses find more options for loans.

Mobile phones help billions of people use financial services.

Faster payments and better access to credit help you grow.

Customer demand pushes fintech to grow.

Fintech lets countries leap ahead without old banking systems.

More people in remote areas can use banking services.

Callout: Fintech opens doors for you and your community, making banking fairer and more flexible.

Sustainable Banking

You see banks caring more about the planet and society. Sustainable banking means banks think about the environment and social issues when making decisions. Many countries now ask banks to follow rules that protect nature and people. Banks use special bonds to raise money for green projects. New tools help banks track their progress and share results with you.

Key Development | Description |

|---|---|

ESG Integration | Banks use global standards to manage environmental and social risks. |

Climate and Nature-Related Risk Management | Banks create rules to handle climate risks, supporting the Paris Agreement. |

SBFN Data Portal | Banks track and compare sustainable finance trends in many countries. |

Thematic Bonds | Banks raise money for green projects with special bonds. |

Note: Sustainable banking helps you support a healthy planet while growing your savings.

Benefit | Description |

|---|---|

Efficiency | Technology makes banking faster and smoother. |

Flexibility | Banks can change quickly to meet your needs. |

Innovation | New ideas help banks serve you better and protect the environment. |

Lower costs and more competition help you get better services.

Mobile banking gives more people access to money.

Sustainable banking supports growth and a better future for everyone.

You see banks connect you, businesses, and the economy every day. A stable banking system supports growth and helps predict economic changes.

Finding | Description |

|---|---|

Positive Link | Banking stability links to real output growth, especially in tough times. |

Economic Forecasting | Stability helps forecast GDP growth more accurately. |

Financial education helps you stay engaged and make smart choices. When you learn about banking trends, you understand how banks support growth, inclusion, and innovation.

Stay curious about banking. Your knowledge shapes your future and your community.

FAQ

What makes your money safe in a bank?

Banks use strong security systems. They protect your account with passwords and encryption. The government insures your deposits. You can trust banks to keep your money safe.

How do you open a bank account?

You visit a bank or use an online form. You show your ID and fill out some paperwork. The bank helps you choose the right account. You start saving or spending right away.

Can you use banking services without visiting a branch?

Yes! You use mobile apps or websites to check your balance, pay bills, and transfer money. Digital banking lets you manage your money from home or anywhere.

Why do some people not have access to banks?

Some people live far from branches. Others do not know how banks work. Lack of documents or financial knowledge can stop people from joining. Mobile banking and education help more people get access.

What is financial inclusion?

Financial inclusion means everyone can use banking services. You get access to accounts, loans, and payments. Banks and fintech companies work to include more people. This helps communities grow.